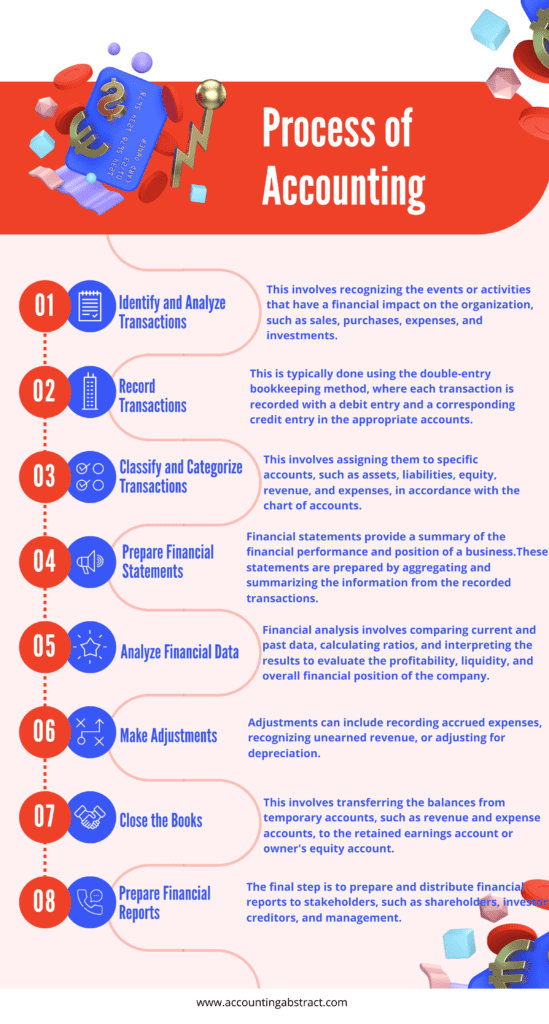

The process of accounting involves several steps that are performed in a systematic manner to record, analyze, and report financial transactions and information. Here are the main steps in the accounting process:

1. Identify and Analyze Transactions: The first step is to identify and analyze the financial transactions that occur within the business. This involves recognizing the events or activities that have a financial impact on the organization, such as sales, purchases, expenses, and investments.

2. Record Transactions: Once the transactions are identified and analyzed, they are recorded in the accounting system. This is typically done using the double-entry bookkeeping method, where each transaction is recorded with a debit entry and a corresponding credit entry in the appropriate accounts.

3. Classify and Categorize Transactions: After recording the transactions, they need to be classified and categorized based on their nature and purpose. This involves assigning them to specific accounts, such as assets, liabilities, equity, revenue, and expenses, in accordance with the chart of accounts.

4. Prepare Financial Statements: Financial statements provide a summary of the financial performance and position of a business. The key financial statements include the income statement, balance sheet, and cash flow statement. These statements are prepared by aggregating and summarizing the information from the recorded transactions.

5. Analyze Financial Data: Once the financial statements are prepared, they are analyzed to assess the financial health and performance of the business. Financial analysis involves comparing current and past data, calculating ratios, and interpreting the results to evaluate the profitability, liquidity, and overall financial position of the company.

6. Make Adjustments: As part of the accounting process, adjustments may be necessary to ensure the financial statements reflect the accrual basis of accounting and provide a true and fair view of the business’s financial position. Adjustments can include recording accrued expenses, recognizing unearned revenue, or adjusting for depreciation.

7. Close the Books: At the end of the accounting period, the books are closed to prepare for the next period. This involves transferring the balances from temporary accounts, such as revenue and expense accounts, to the retained earnings account or owner’s equity account.

8. Prepare Financial Reports: The final step is to prepare and distribute financial reports to stakeholders, such as shareholders, investors, creditors, and management. These reports provide an overview of the financial performance and position of the business and help in decision-making, planning, and compliance with regulatory requirements.

It’s important to note that the accounting process may vary depending on the size and complexity of the organization, as well as the accounting standards and regulations applicable in a particular jurisdiction. However, the core steps mentioned above form the foundation of the accounting process in most businesses.