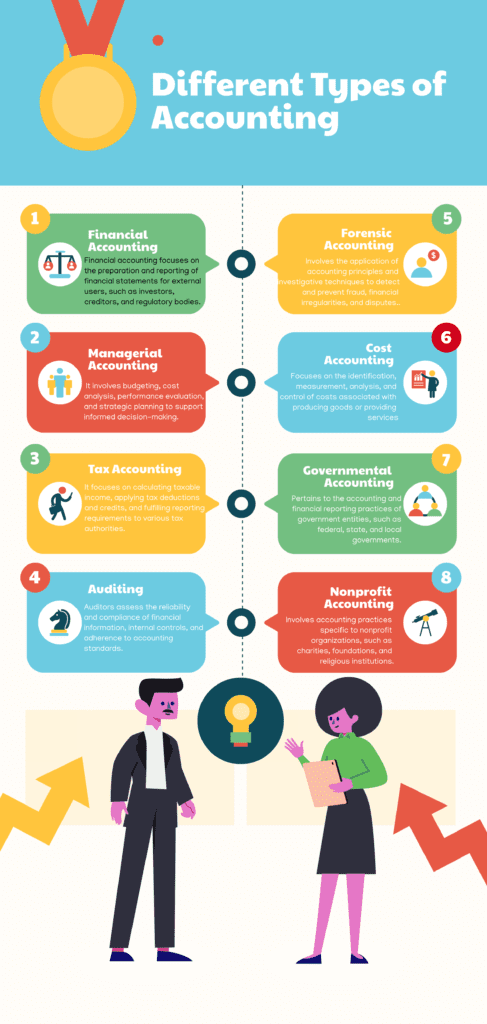

There are several different types of accounting that serve various purposes and cater to different needs. Here are some of the major types of accounting:

- • Financial Accounting: Financial accounting focuses on the preparation and reporting of financial statements for external users, such as investors, creditors, and regulatory bodies. It involves recording, summarizing, and presenting financial transactions in accordance with accounting standards.

- • Managerial Accounting: Managerial accounting, also known as management accounting, provides financial information and analysis to internal users, typically management and decision-makers within an organization. It involves budgeting, cost analysis, performance evaluation, and strategic planning to support informed decision-making.

- • Tax Accounting: Tax accounting involves the preparation and filing of tax returns and ensuring compliance with tax laws and regulations. It focuses on calculating taxable income, applying tax deductions and credits, and fulfilling reporting requirements to various tax authorities.

- • Auditing: Auditing is an independent examination of financial statements and records to express an opinion on their accuracy and fairness. Auditors assess the reliability and compliance of financial information, internal controls, and adherence to accounting standards.

- • Forensic Accounting: Forensic accounting involves the application of accounting principles and investigative techniques to detect and prevent fraud, financial irregularities, and disputes. Forensic accountants often work closely with legal professionals and may provide expert testimony in legal proceedings.

- • Cost Accounting: Cost accounting focuses on the identification, measurement, analysis, and control of costs associated with producing goods or providing services. It helps businesses determine product costs, analyze profitability, and make informed pricing decisions.

- • Governmental Accounting: Governmental accounting pertains to the accounting and financial reporting practices of government entities, such as federal, state, and local governments. It follows specific accounting standards and regulations designed for the unique needs and transparency requirements of the public sector.

- • Nonprofit Accounting: Nonprofit accounting involves accounting practices specific to nonprofit organizations, such as charities, foundations, and religious institutions. It addresses the unique aspects of fund accounting, donations, grants, and compliance with nonprofit regulations.

These are some of the major types of accounting, each serving specific purposes and catering to different stakeholders. Accountants may specialize in one or more of these areas based on their expertise and professional goals..